Author: Mr. Jean Marais, Founder & Group Executive Chairman

Sanodea Group. Rooted in Africa. Connected to the World.

Presence: Africa, Europe, Middle East, Asia, North America

Executive Summary

Between 2030 and 2040, Africa will become the epicentre of global competition for critical minerals, energy security, and strategic supply-chain influence. This flagship foresight paper presents a Sanodea Group perspective on how African mines — and the governments that govern them — must position themselves within a rapidly shifting geopolitical ecosystem.

We outline an evidence-based blueprint for how African mining systems can strengthen negotiating power, secure long-term value, and attract strategic capital while reducing exposure to global volatility. This paper highlights three horizons: 2030, 2035, and 2040 — each characterised by distinct geopolitical dynamics, technology cycles, and operating risks.

This analysis is designed for sovereign decision-makers, boards, DFIs and institutional investors navigating the next era of mineral diplomacy, energy transition, and industrial realignment.

“By 2040, Africa’s mines will not compete on tonnes or grades — they will compete on stability, legitimacy, transparency, and strategic alignment.” – Jean Marais

1. Why 2030–2040 Matters — The Geopolitical Imperative

Africa holds over a third of the world’s critical mineral reserves, yet contributes a fraction of global refined output. As China, the U.S., EU, India and Gulf economies expand their energy-transition agendas, Africa’s minerals have become strategic assets — not commodities.

Three seismic shifts define the decade:

1. The race for mineral security

Minerals like cobalt, lithium, manganese, nickel, copper and REEs are now part of national security doctrines.

2. The rise of mineral diplomacy

Geopolitical influence will increasingly be tied to long-term mineral partnerships, infrastructure corridors, and “friend-shoring.”

3. The decline of commodity-style mining

Responsible, transparent and digitally verifiable production will become a prerequisite for access to capital and global markets.

Africa must move from price-taker to system architect within global supply networks.

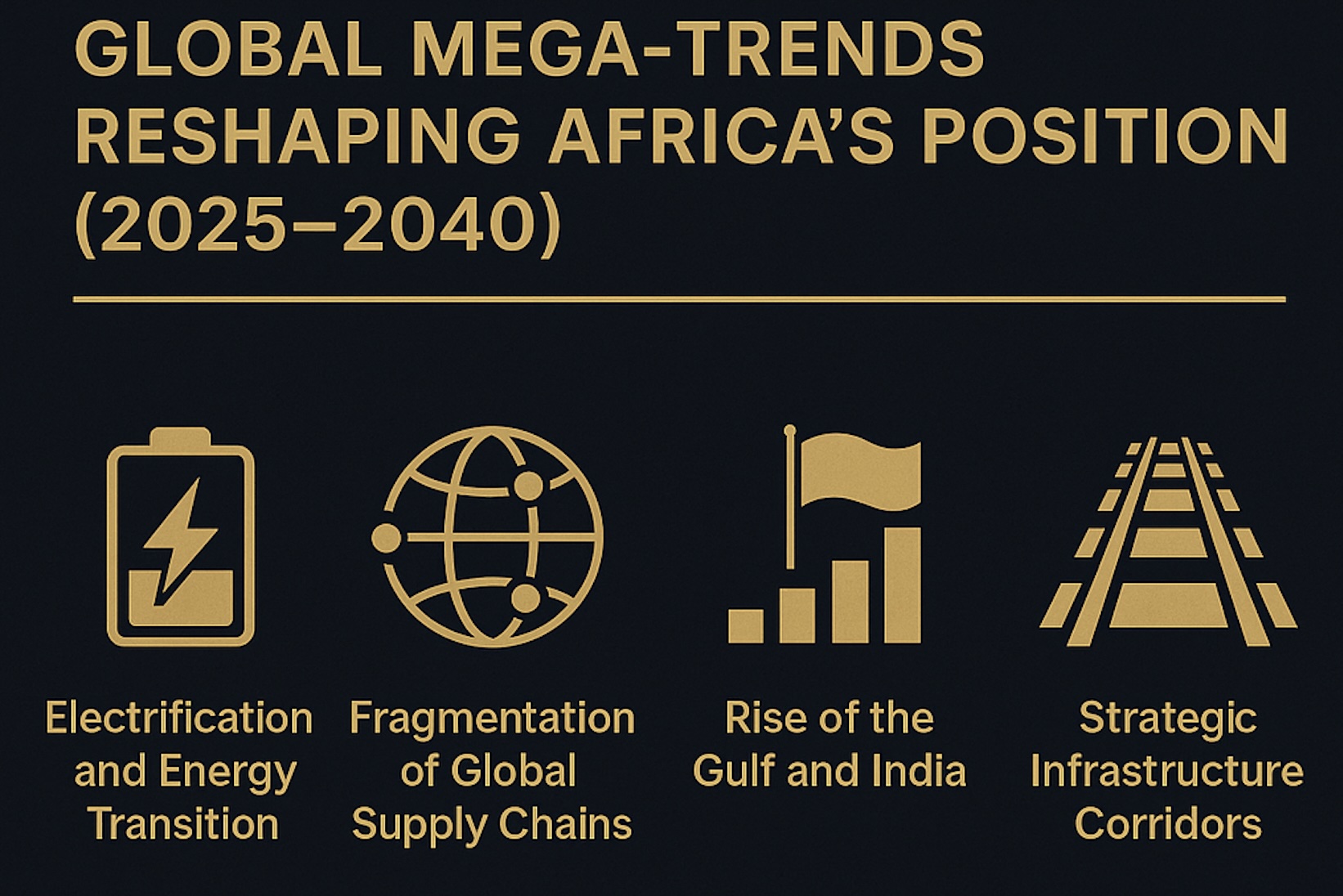

2. Global Mega-Trends Reshaping Africa’s Position (2025–2040)

Electrification and Energy Transition

Demand for battery minerals will reshape global capital flows and bilateral partnerships.

Fragmentation of Global Supply Chains

U.S.–China competition, EU raw materials policies, and Gulf investment blocs will drive multi-polar competition for African resources.

Rise of the Gulf and India

GCC sovereign funds and India’s industrial push will play a pivotal role in Africa’s mining and logistics investment.

Strategic Infrastructure Corridors

Rail, port, energy and data-infrastructure corridors become essential geopolitical assets.

Finance: From ESG to Verification

Investors will demand third-party verified ESG, carbon and traceability data — not self-reported claims.

Technology as a Condition for Market Access

Digital twins, traceability systems, and real-time reporting will become mandatory for integration into global supply chains.

3. The Three Horizons — 2030 → 2035 → 2040 (Sanodea Foresight Model)

This foresight model defines the strategic positioning African mining systems must reach in each horizon.

Horizon 2030 — Securing Position in Global Mineral Ecosystems

Focus: Legitimacy, transparency and investment attraction.

Strategic Requirements

-

Establish national minerals data platforms.

-

Digitise cadastre & permitting systems.

-

Launch traceability standards for key minerals.

-

Strengthen public–private coordination and procurement governance.

-

Build early mineral diplomacy capabilities within governments.

Outcome by 2030:

Africa becomes a more predictable investment destination with early control over mineral data, permitting, and reporting.

Horizon 2035 — Building Industrial Leverage & Strategic Autonomy

Focus: Partial beneficiation, regional integration, and supply-chain resilience.

Strategic Requirements

-

Structured JV frameworks with global OEMs and midstream players.

-

Regional integration through mineral corridors and shared logistics.

-

Digital integration across mines, ports, power systems and regulators.

-

Build national refining capacity for select minerals.

-

Establish ESG-linked trade agreements and value-chain charters.

Outcome by 2035:

Africa begins to exert negotiating power — with verifiable ESG performance, reliable supply, and localised value addition.

Horizon 2040 — Sovereign Advantage & Global System Integration

Focus: Full transparency, localised supply chains, and advanced industrial ecosystems.

Strategic Requirements

-

Near-autonomous mining and logistics systems.

-

Cross-border energy transition grids (hydro, solar, interconnectors).

-

Integrated carbon markets for African minerals.

-

AI-enabled mineral intelligence hubs.

-

Deepened sovereign partnerships with major trading blocs.

Outcome by 2040:

Africa becomes a strategic anchor of global mineral supply — with sovereign control over data, processing, and long-term value creation.

4. Institutional Case Studies (Sanodea Experience — Regional & Anonymised)

Case Study 1 — Central African Corridor: Sovereign Data Advantage

Challenge: Disparate data, weak negotiation position.

Approach: Minerals data platform, digital cadastre, concession audit.

Outcome: Improved fiscal terms; major DFI-backed corridor investment unlocked.

Case Study 2 — Southern African Battery Metals Project

Challenge: No access to premium markets due to limited ESG visibility.

Approach: Traceability stack, carbon accounting integration, offtake transparency.

Outcome: Secured long-term contracts with EU and East Asian buyers.

Case Study 3 — East African Regional Mining Cluster

Challenge: Fragmented cross-border logistics and bottlenecks.

Approach: Shared corridor model, cross-border supply-chain governance, port digitalisation.

Outcome: 35–45% reduction in logistics delays; improved competitiveness for regional exports.

Case Study 4 — West African National Strategy Programme

Challenge: Weak local content and limited technical leadership.

Approach: Localisation blueprint, leadership academies, technical partnerships.

Outcome: Reduced expatriate dependency and improved sovereign retention.

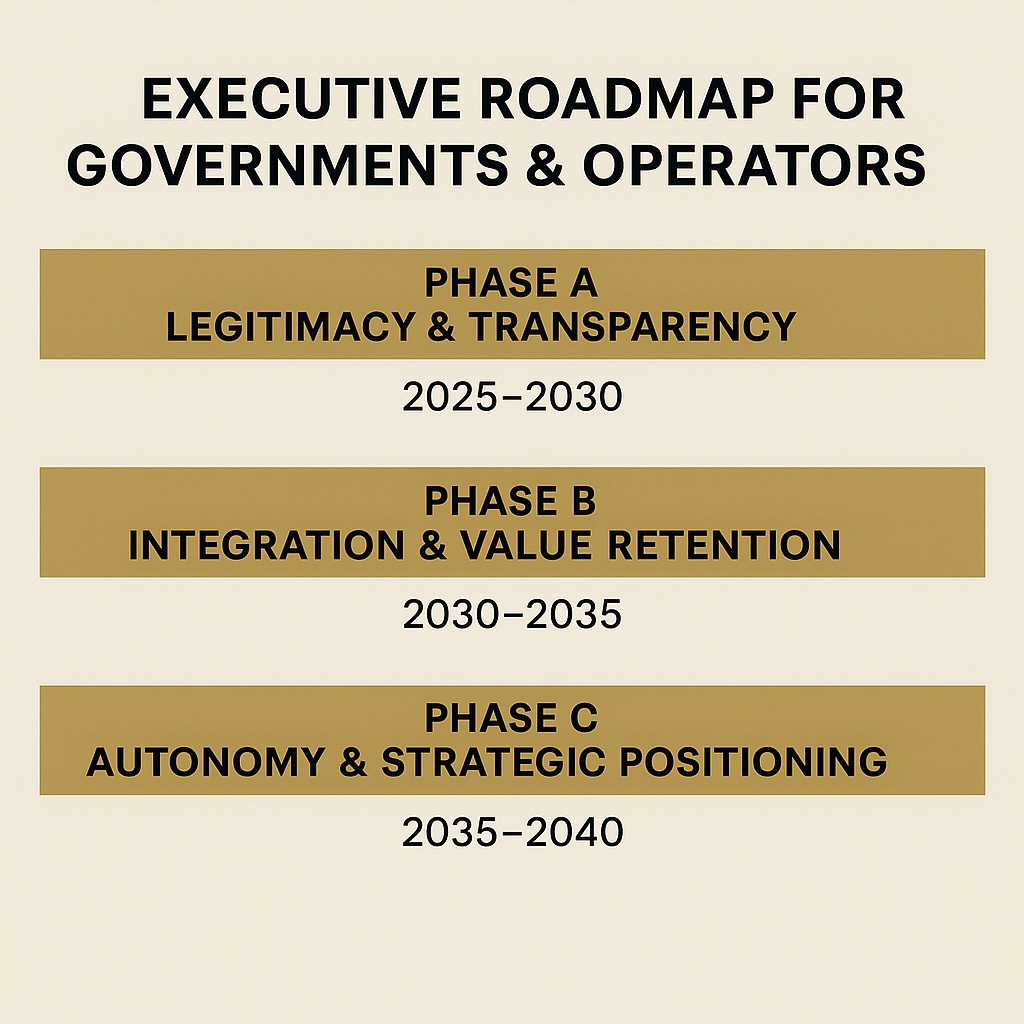

5. Executive Roadmap for Governments & Operators (Actionable Milestones)

Phase A — 2025–2030: Legitimacy & Transparency

-

Digitise cadastre and permitting.

-

Establish minerals data sovereignty frameworks.

-

Adopt global traceability standards.

-

Strengthen governance and procurement oversight.

Phase B — 2030–2035: Integration & Value Retention

-

Build beneficiation capabilities.

-

Develop cross-border logistics corridors.

-

Integrate ESG systems across national value chains.

-

Leverage DFIs for blended finance and green investment.

Phase C — 2035–2040: Autonomy & Strategic Positioning

-

Deploy autonomous operational technologies.

-

Build African refining clusters.

-

Introduce digital marketplaces for mineral trading.

-

Embed national AI mineral intelligence systems.

6. Expected Outcomes & Strategic Value

When implemented across 2030–2040, governments and operators can expect:

-

Stronger negotiation leverage with global blocs.

-

Greater share of mineral value retained domestically.

-

Increased transparency and lowered investor risk premiums.

-

Reduced logistics cost and improved export competitiveness.

-

Higher ESG scores unlocking cheaper capital and expanded markets.

-

Stable, predictable, and long-term mineral partnerships.

7. Sanodea Group — How We Partner for Africa’s Strategic Advantage

Sanodea supports governments and multinationals through:

-

Strategy & Foresight — National mining strategies, corridor blueprints, sovereign risk navigation.

-

Digital Innovations — Cadastre digitalisation, traceability stacks, carbon accounting, SanoMineIQ™ for national mining systems.

-

Resources — Ethical frameworks, market access programmes, certification pathways.

-

Connect — Global partnerships, DFI engagement, investment mobilisation.

-

Legacy — Workforce and leadership pipelines, institutional capability building.

Our engagements focus on measurable, sovereign-aligned outcomes that strengthen Africa’s geopolitical and economic autonomy.

8. Governance & Risk — Core Considerations for 2030–2040

-

Data sovereignty: National control of mineral intelligence is non-negotiable.

-

Contract stability: Transparent, digital contracting reduces disputes and investor risk.

-

Cross-border governance: Corridor governance must be regionally harmonised.

-

Human capital: Leadership, governance and institutional capacity remain the highest-impact deficit.

Conclusion — Africa’s Geopolitical Window Is Now

Between 2030 and 2040, Africa can become a global pillar of mineral supply, energy transition and industrial stability. The question is not whether Africa can lead — but whether operators and governments will adopt the systems required to capture long-term value.

Resilient, sovereign-aligned, digitally verified mining systems are no longer an aspiration.

They are a geopolitical necessity.

Sanodea leads. Africa advances. The future is strategic — and the future is African.

References

-

African Development Bank (AfDB). African Economic Outlook: Mobilising Resources for Africa’s Green Growth. 2024.

-

African Union Commission. Africa Mining Vision – Implementation Report. 2023.

-

BloombergNEF (BNEF). Critical Minerals Market Outlook. 2024.

-

Brookings Institution. Geopolitics of the Energy Transition: Implications for Africa. 2023.

-

Chatham House. China–Africa Relations in the New Geopolitical Era. 2023.

-

Deloitte. Tracking the Trends: The Top Issues in Mining. 2024.

-

European Union (EU). Critical Raw Materials Act – Strategic Assessment. 2023.

-

International Energy Agency (IEA). Africa Energy Outlook. 2024.

-

International Finance Corporation (IFC). ESG Standards and Responsible Minerals Sourcing. 2023.

-

International Monetary Fund (IMF). Sub-Saharan Africa Regional Economic Outlook. 2024.

-

International Renewable Energy Agency (IRENA). Global Critical Materials Outlook. 2023.

-

KPMG. Global Mining and Metals Outlook. 2024.

-

McKinsey & Company. The Future of Minerals in a Multipolar World. 2024.

-

Organisation for Economic Co-operation and Development (OECD). Responsible Mineral Supply Chains. 2023.

-

United Nations Economic Commission for Africa (UNECA). African Mineral Governance Framework. 2024.

-

World Bank Group. Africa’s Resource Governance Diagnostics. 2023.

-

World Economic Forum (WEF). Energy Transition Insight Report. 2024.

-

World Trade Organization (WTO). Global Trade and Mineral Security Outlook. 2024.

-

Marais, J.Y. Sanodea Group — Strategic Foresight Notes. (Internal), 2025.