Author: Mr. Jean Marais, Founder & Group Executive Chairman

Sanodea Group. Rooted in Africa. Driven by Innovation. Built for Global Impact.

Presence: Africa, Europe, Middle East, Asia, North America

It defines the ore body, guides investment decisions, reduces geological ambiguity, and sets the foundation for whether a project becomes a world-class asset or an expensive failure.

Across more than 30 years leading and advising mining operations, I have seen billions lost not due to geology — but due to poor drilling strategy, unreliable contractors, and inefficient execution.

As mining across Africa accelerates, the industry must re-engineer how it views drilling: not as a procurement activity, but as a core strategic capability. This case study outlines a forward-looking framework for how African operations can leverage elite drilling partners and precision engineering to unlock value, reduce risk, and accelerate development timelines.

Executive Summary: Why Exploration Drilling Quality Determines Mining Success

The global mining environment is tightening: capital is selective, ESG compliance is mandatory, and investors expect clear geological visibility before committing funds. Drilling is no longer merely a physical operation — it is the analytical engine that drives valuation.

Across projects I’ve overseen, the difference between high-quality drilling and poor execution has produced swings of:

-

20–40% in inferred vs indicated resource classification

-

30–50% variance in cost per metre due to re-drilling or poor recovery

-

12–24 months delays in feasibility timelines

-

Tens to hundreds of millions in NPV impact

The stakes are even higher at today’s commodity prices. At USD 4,000/oz+ gold, a feasibility decision delayed by six months can erase up to USD 250–400 million in unrealised value for a mid-tier project.

In this environment, drilling excellence is not a service — it is strategic infrastructure.

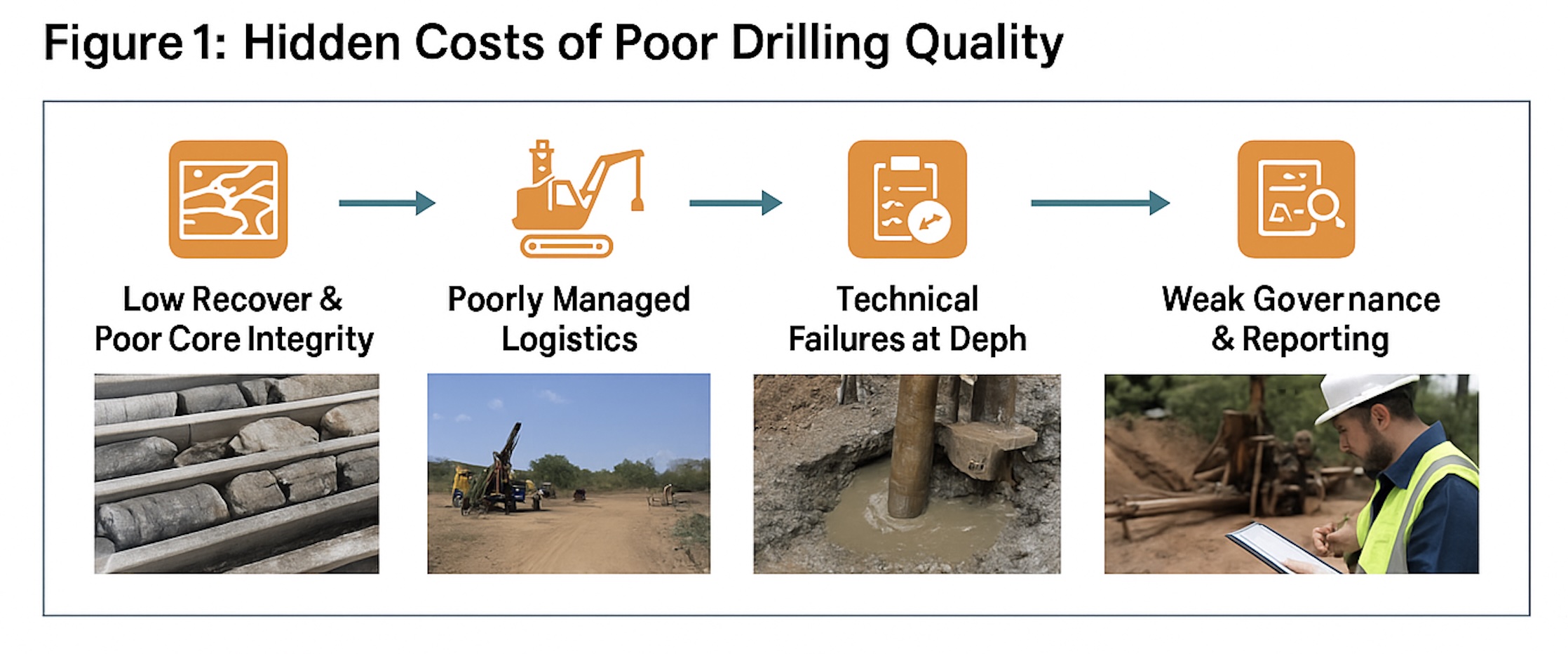

Chapter 1: The Hidden Costs of Poor Drilling Quality

From West Africa to East Africa to the Copperbelt, I have observed recurring failure patterns in exploration drilling environments:

1. Low Recovery & Poor Core Integrity

1. Low Recovery & Poor Core Integrity

Broken core, washed-out intersections, and inconsistent recovery undermine geological confidence.

A single campaign can lose 20–30% usable geological data.

2. Misaligned Drilling Technology

Using rigs not suited for terrain, depth, or access constraints leads to:

-

Excessive downtime

-

Slow penetration rates

-

Unsafe working conditions

3. Poorly Managed Logistics

Remote sites with limited access amplify risks:

-

Delayed rig mobilisation/demobilisation

-

Lost drilling days

-

Emergency cross-border spares

4. Technical Failures at Depth

Unstable holes, collapsing walls, stuck rods, or poor fluid management can destroy an entire hole and force a complete re-drill.

5. Weak Governance & Reporting

Inconsistent daily drill logs, low-resolution geological data, and undocumented deviations create inaccurate block models.

Case Example (Anonymised):

A West African gold project experienced a 14-day shutdown due to repeated drilling assembly failures. The NPV reduction from delayed feasibility exceeded USD 90 million — more than 20× the cost of a premium drilling contractor.

Poor drilling is not a cost issue — it is a valuation erosion issue.

Chapter 2: The Sanodea Exploration Drilling Excellence Framework

To mitigate drilling risk and accelerate project viability, we deploy a six-pillar framework:

1. Board-Level Geological Governance

Boards must own drilling KPIs:

-

Cost/meter

-

Recovery %

-

Penetration rates

-

Time to depth

-

OHSE adherence

-

Variance against planned metres

In every high-performing project I’ve advised, these metrics are reviewed at board or investment committee level.

2. Fit-for-Purpose Drilling Technology

This includes advanced heli-portable and man-portable rigs, RC/aircore systems, and modular support units designed for ultra-remote access. The goal is simple: reach the ore body where trucks and heavy equipment cannot.

3. Precision Engineering & Reliability

Drilling rigs must operate as engineered ecosystems — not collections of parts.

We emphasise:

-

High-performance rod handling

-

Stabilised torque systems

-

Optimised drilling fluids

-

Remote terrain package engineering

-

Certified components and ISO-driven QC

4. Skilled Drilling Workforce & On-Site QA/QC

The calibration of the operator often matters more than the machine:

-

Proper alignment

-

Correct bit selection

-

Angle tolerance

-

Fluid dynamics

-

Real-time recovery oversight

5. Data Integrity & Geological Analytics

Exploration drilling today requires:

-

Digital daily logs

-

Automated recovery tracking

-

Geo-referencing

-

Photogrammetry

-

Downhole telemetry

In one copper project, implementing a structured QC protocol improved core utility by 37%.

6. Supply Chain, Spares & Logistics Capability

A drilling program is only as strong as its logistics chain.

This includes:

-

Guaranteed spares delivery

-

Remote-site maintenance capability

-

Fast recovery plans for equipment failures

The mines that succeed treat drilling logistics as mission-critical infrastructure.

Chapter 3: Anonymised Case Studies — Operational Proof Points

Case Study A — Greenfield Gold Project, West Africa

A remote, canopy-dense region required lightweight yet high-torque rigs capable of deep drilling without heavy equipment access.

Intervention:

-

Switched to modular heli-portable rigs

-

Introduced high-strength, low-weight assemblies

-

Implemented onsite geotech QA/QC protocols

Outcomes:

-

Drilled 20% faster

-

Reduced logistics costs by 35%

-

Improved recovery to >92%

-

Completed the program 2 months ahead of schedule

Case Study B — East African Multi-Commodity Project

Frequent rod failures and collapsing boreholes undermined geological modelling.

Intervention:

-

Introduced engineered coupling systems

-

Stabilised torque & pressure envelopes

-

Retrained drill teams on fluid dynamics

-

Deployed incident-prediction analytics

Outcomes:

-

Rod failure incidents dropped by 70%

-

Hole collapse reduced by 60%

-

Feasibility timelines recovered by 8 months

Case Study C — Copperbelt Exploration Program, Southern Africa

The project was located in rugged, high-altitude terrain with no conventional road access.

Intervention:

-

Deploy ultra-mobile, man-portable rigs

-

Establish aerial resupply chain

-

Embed predictive component monitoring

Outcomes:

-

Exploration completed with zero lost-time incidents

-

Achievement of full planned metres under budget

-

Faster conversion from inferred to indicated resources

Chapter 4: Expected Outcomes & Benchmarks for Modern Drilling Partnerships

Mines that adopt a modern drilling excellence model consistently achieve:

-

25–45% faster drilling progress

-

20–35% higher recovery rates

-

40–60% reduction in technical failures

-

15–30% improvement in resource classification

-

20–30% savings in drilling cost per usable metre

-

Enhanced valuation uplift through accelerated feasibility

This is the new baseline for Africa’s mining competitiveness.

Chapter 5: Strategic Value Across Stakeholders

For Investors

Higher-quality geological data reduces uncertainty → lower discount rates → higher valuations.

For Governments

Accelerated resource definition → faster royalties → stable development timelines.

For Communities

Fewer disruptions → safer operations → stronger social licence.

For Operators

Better forecasting → more accurate mine planning → faster project execution.

Drilling excellence is value creation at the earliest stage of the mining lifecycle.

Chapter 6: Sanodea Group’s Role in Drilling Transformation

Sanodea Group works across the entire drilling ecosystem to deliver high-confidence exploration outcomes:

-

Sanodea Advisory — governance, strategy, feasibility alignment

-

Sanodea Innovations — digital tracking, predictive systems, telematics

-

Sanodea Commerce — partnerships with premium equipment manufacturers & component suppliers

-

Sanodea Resources — execution oversight and performance management

-

Sanodea Life — OHSE systems and workforce competence

-

Sanodea Legacy — training, skills development, and national content

Our approach embeds drilling excellence into the operation’s DNA, not as a contract — but as a transformation capability.

Conclusion

Africa’s mining resurgence will not be driven by luck or high commodity prices — it will be driven by precision, reliability, and disciplined execution during exploration. Drilling excellence determines project viability, investor confidence, and long-term competitiveness. Mines that embrace engineered drilling ecosystems, robust QC, and strategic partnerships will secure an undeniable advantage in the decade ahead.

Sanodea Group

Advisory | Innovations | Commerce | Resources | Life & Wellness | Legacy & Education

explore. Engage. EVOLVE.

References

-

AusIMM. Exploration Drilling Practice: Guidelines for Core, RC, and Aircore Drilling. Australasian Institute of Mining & Metallurgy, 2022.

-

CSA Global. Core Recovery, Geological Logging, and QA/QC Best Practices in Exploration Programmes. CSA Global Technical Bulletin, 2021.

-

International Council on Mining & Metals (ICMM). Safety Performance in Exploration and Drilling Operations. ICMM Report, 2023.

-

International Finance Corporation (IFC). Environmental, Health, and Safety Guidelines for Mining and Exploration Activities. World Bank Group, 2022.

-

JORC Committee. JORC Code: Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves. JORC, 2012 (updated 2024).

-

McKinsey & Company. Optimising Exploration Productivity Through Technology-Enabled Drilling Systems.McKinsey Metals & Mining Insight, 2023.

-

NI 43-101 Standards of Disclosure for Mineral Projects. Canadian Securities Administrators (CSA). Updated 2023.

-

PwC. Mine 2024: Trends in Exploration, Discovery, and Resource Conversion. PwC Global Mining Outlook, 2024.

-

Sanodea Group. Exploration Drilling Excellence, Field Reliability, and Operational Transformation Reports (2025). Internal Publications.

-

SRK Consulting. Best Practice Guidelines for Exploration Drilling QA/QC and Geological Data Integrity. SRK Technical Paper Series, 2023.