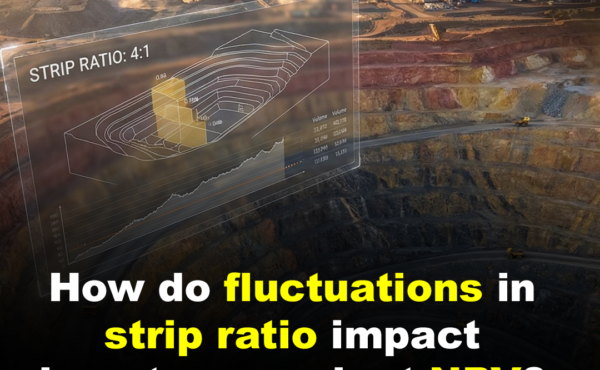

Strip ratio fluctuations directly impact project NPV by altering the timing and magnitude of cash outflows. In open-pit mining, a sudden spike in SR—often caused by unforeseen geological conditions or pit wall failures—forces unplanned capital into waste removal, effectively “pushing back” the high-value ore and discounting future revenues more heavily (Read & Stacey, 2009).

Strategic mine sequencing aims to “front-load” low-ratio ore to maximize early cash flow, but poor stability or design changes can invert this balance. Research indicates that a shift in the average strip ratio from 3:1 to 6:1 can reduce a project’s total NPV by 35–50%, primarily due to the increased operating costs and the high time-value cost of deferred production (Discovery Alert, 2025).

Ultimately, a stable and optimized strip ratio is the foundation of a robust Life-of-Mine (LOM) plan. By integrating probabilistic slope design and dynamic scheduling, operators can mitigate the risk of “waste gaps” and ensure that the project remains economically resilient against market volatility and geological uncertainty (Kanchibotla, 2003; Hamd-Allh et al., 2020).

Is your mine plan flexible enough to handle a 10% spike in waste stripping without crashing your NPV? How are you balancing short-term cash flow against long-term geotechnical stability?

References:

-

Discovery Alert. (2025). Strip Ratio in Open-Pit Mining: Cost & Calculation Guide.

-

Hamd-Allh, H. H., et al. (2020). Effect of Cutoff Grade and Stripping Ratio on the Net Present Value.

-

Read, J., & Stacey, P. (2009). Guidelines for Open Pit Slope Design.