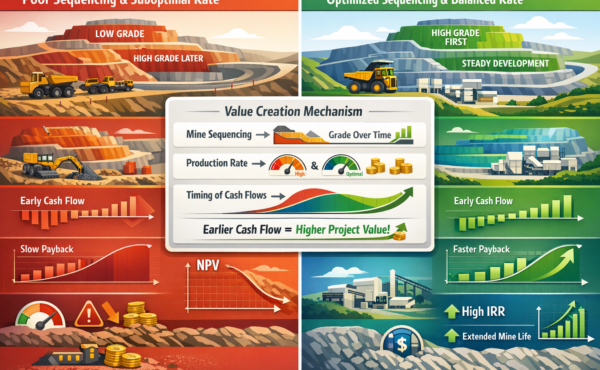

In the mineral industry, the strategic alignment of mine sequencing and production rate selection is the primary determinant of a project’s Net Present Value (NPV) and long-term financial viability. While geological excellence defines the resource, it is the temporal arrangement of extraction, sequencing, and the scale of operation, production rate, that convert mineral physicalities into discounted cash flows.

The Economic impact of production rate selection

The selection of an optimal production rate is a balancing act between economies of scale and the law of diminishing returns. According to Taylor’s Rule (1977), a traditional industry benchmark, mine capacity should generally be proportional to the three-quarters power of the estimated reserve tonnage. However, modern research by Long (2009) suggests that technological advancements have shifted this relationship, necessitating higher capacities to maintain competitiveness.

- Economies of scale: increasing the production rate typically reduces the unit operating cost ($/tonne) by spreading fixed costs over a larger volume of material.

- Capital intensity: while higher rates improve the unit cost, they require exponentially higher initial capital expenditure (CAPEX) for larger processing plants, fleets, and infrastructure.

- The time value of money: faster extraction brings revenue forward in time. Because of the discount rate, a dollar earned in Year 2 is worth significantly more than a dollar earned in Year 20. Selecting a higher production rate shortens the Mine Life, thereby increasing the present value of those cash flows (Pamukcu, 2015).

Mine sequencing and the front-loading of value

Mine sequencing, the order in which blocks of ore and waste are extracted, is the engine of the project’s cash flow. The objective of sequence optimization is generally to “front-load” the highest value material while deferring costs.

High-grade strategy

Effective sequencing prioritizes high-grade ore in the early years of operation. According to Lane’s Theory (1988), maximizing NPV often requires a declining cut-off grade strategy. By processing the richest ore first, the mine generates robust early cash flows that can repay initial debt and improve the Internal Rate of Return (IRR). As the project matures and the NPV of future cash flows declines, the cut-off grade is lowered to include lower-grade material (Moosavi et al., 2014).

Pushback design and stripping ratios

In open-pit mining, sequencing is managed through “pushbacks” or nested pits. Strategic sequencing aims to minimize the Stripping Ratio (the ratio of waste to ore) in the early years. If waste removal is deferred too long, the mine may face a “waste gap” where production halts to allow for stripping, leading to negative cash flow periods (Fontes, 2020).

Interaction between rate and sequence

The production rate and sequence are not independent. A higher production rate allows for more aggressive sequencing and the ability to process marginal ore that would otherwise be classified as waste under a slower, higher-cost regime. Research by Abdel Sabour (2002) highlights that the optimum production rate is reached when the marginal revenue of increasing capacity equals the marginal cost of that expansion.

Summary of financial drivers

|

Strategic Decision |

Primary financial driver |

Effect on project value |

|

Increased Production Rate |

Economies of Scale |

Increases NPV by accelerating cash flows but increases CAPEX risk. |

|

Optimized Sequencing |

High-Grade Front-loading |

Enhances early cash flow and improves IRR; lowers payback period. |

|

Dynamic Cut-off Grade |

Opportunity Cost |

Maximizes total resource value by adapting to the declining NPV over time. |

Conclusion

Mine sequencing and production rate selection are the most powerful levers available to mine planners. While the production rate sets the scale of the “engine,” sequencing determines how that engine is fueled over time. Together, they ensure that the project remains resilient against price volatility and technical uncertainties (Dimitrakopoulos & Ramazan, 2004).

References

Abdel Sabour, S. A. (2002). Marginal analysis for the determination of optimal mine size. Mineral Resources Engineering.

Dimitrakopoulos, R., & Ramazan, S. (2004). Uncertainty-based production scheduling in open pit mining. Journal of Mining Science.

Fontes, M. P. (2020). Influence of water level and stripping ratio in mine sequencing applied to strategic mining planning. SciELO.

Lane, K. F. (1988). The Economic Definition of Ore. Mining Journal Books.

Long, K. R. (2009). A Test and Re-Estimation of Taylor’s Empirical Capacity–Reserve Relationship. Natural Resources Research.

Moosavi, M., et al. (2014). Optimal extraction sequence modeling considering dynamic cutoff grade. Mineral Resources Management.

Pamukcu, C. (2015). Determination of Optimum Production Capacity and Mine Life Considering Net Present Value. Acta Montanistica Slovaca.