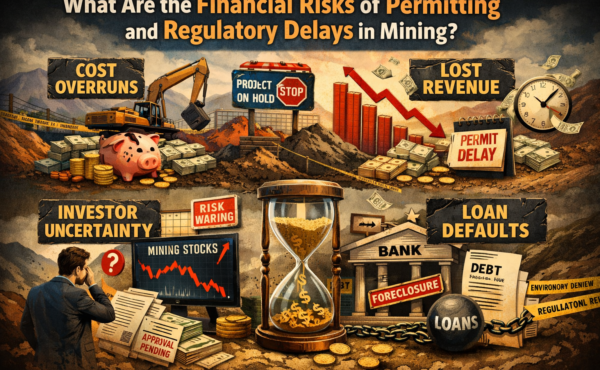

Permitting and regulatory delays in the mining industry are not just administrative hurdles; they are significant financial “value destroyers [1].” Because mining is a capital-intensive industry with long lead times, a delay of even a few months can have a massive impact on the project’s bottom line.

The financial risks can be categorized into four primary areas:

Massive erosion of project value (NPV)

The Net Present Value (NPV) of a mine is highly sensitive to the timing of the first cash flow. Delays push revenues further into the future while costs are incurred in the present.

- Weekly losses: for large-scale projects (CapEx of $3B–$5B), research from the ERM Sustainability Institute indicates that each week of delay can cost approximately $20 million in lost NPV [2].

- Total value loss: studies by the National Mining Association suggest that bureaucratic delays can reduce a typical mine’s total value by one-third to one-half before it even begins production [3].

Capital cost overruns and inflation

Delaying a project doesn’t just stall progress; it makes the eventual construction more expensive [4].

- Cost inflation: during the delay, the cost of labor, fuel, and raw materials (steel, concrete, explosives) often rises. A project budgeted in 2024 may be 20–40% more expensive to build by 2027.

- Holding costs: companies must continue to pay “care and maintenance” costs, staff salaries, and land access fees without any incoming revenue.

- Interest expenses: if a project is debt-financed, interest continues to accrue during the delay period, significantly increasing the total debt burden.

“Dead” capital and investor flight

Mining investors, particularly for “Junior” miners who rely on equity markets, are highly sensitive to momentum.

- Opportunity cost: capital tied up in a stalled project is “dead capital” that cannot be reinvested elsewhere.

- Investor Sentiment: prolonged uncertainty often leads to a drop in stock price [2]. Junior miners may find themselves unable to raise more capital, leading to insolvency or predatory takeovers.

- The “window of opportunity”: commodity prices are cyclical [5]. A project delayed by three years might miss the “peak” of a price cycle (e.g., a lithium or copper boom), turning a highly profitable venture into one that is barely break-even.

Litigation and Compliance Costs

Regulatory delays often stem from or lead to legal challenges [4].

- Legal fees: defending permits against environmental or community challenges in court can cost millions in legal fees.

- Rework costs: if regulations change during the delay (e.g., new carbon taxes or stricter water discharge limits), the company may have to spend millions on “re-engineering” the mine plan to stay compliant.

Reference

[1] “New study shows the economic effects of permitting delays on the U.S. mining industry – MINING.COM.” Accessed: Jan. 12, 2026. [Online]. Available: https://www.mining.com/web/new-study-shows-economic-effects-permitting-delays-u-s-mining-industry/

[2] “Reducing delays is the crucial lever to driving up success rates for critical mineral mining projects, according to research from ERM.” Accessed: Jan. 12, 2026. [Online]. Available: https://www.erm.com/about/news/reducing-delays-is-the-crucial-lever-to-driving-up-success-rates-for-critical-mineral-mining-projects-according-to-research-from-erm/

[3] nickoli.riggins@oceanagold.com, “Study Finds Permit Delays Harm Mining Investment, Minerals Supply Chain,” National Mining Association. Accessed: Jan. 12, 2026. [Online]. Available: https://nma.org/study-finds-permit-delays-harm-mining-investment-minerals-supply-chain/

[4] I. Michael, “Regulatory Hurdles and Permitting Delays,” Jun. 2025.

[5] “Overview of Risks in Each Stage of Mining Industry Development,” Tura Consulting Indonesia. Accessed: Jan. 12, 2026. [Online]. Available: https://tura.consulting/insight/overview-of-risks-in-each-stage-of-mining-industry-development/